Beneficial Ownership Information,BOI,Corporate Transparency Act,CTA,Financial Crimes Enforcement Network,FinCEN,FTAF,money laundering

Beneficial Ownership Information,BOI,Corporate Transparency Act,CTA,Financial Crimes Enforcement Network,FinCEN,FTAF,money laundering

No comments

No comments

Money Laundering in the Art World: The Consequences of Weakening, or revoking, the Corporate Transparency Act

The Corporate Transparency Act was enacted in 2021. With the passing of the a bipartisan CTA, domestic entities created by a filing with a state secretary of state and foreign entities that registered to do business in the U.S. are required to submit Beneficial Ownership Information (BOI) about the entities true owners to the Financial Crimes Enforcement Network or FinCEN. The Act aims to combat illicit financial activities, including money laundering, by preventing the misuse of anonymous shell companies and closed loopholes by requiring transparency in corporate structures, making it harder for criminals to hide behind front companies or offshore entities.

How It Helps Combat Money Laundering in the Art Market:

Identifying Beneficial Owners – The CTA required certain U.S. businesses to disclose their true owners (beneficial owners) to the Financial Crimes Enforcement Network (FinCEN). This reduced the availability of anonymous shell companies which could be used to buy or sell high-value artworks as a way to launder money.

Closing Loopholes – The art market has long been an attractive space for criminals due to its anonymous transactions. By requiring transparency in corporate structures, the CTA made it harder for criminals, or sanctioned individuals, to hide behind front companies or offshore entities.

Enhancing Law Enforcement Investigations – With a registry of beneficial owners, law enforcement agencies could better trace illicit funds and investigate suspicious art transactions tied to money laundering, terrorism financing, or sanctions evasion.

Deterring Criminal Actors – Knowing that corporate ownership records are accessible to regulators and enforcement agencies created a deterrent effect, making it riskier for bad actors to use the art market for financial crimes.

Aligning with Global Anti-Money Laundering Efforts – The CTA brought the U.S. closer to international AML standards, reinforcing Financial Action Task Force (FATF) recommendations that called for greater transparency in high-value transactions, including art.

Recent Developments Under the Trump Administration:

On 2 March 2025, the U.S. Treasury Department, with endorsement of President Donald Trump's administration, announced that FinCEN will not take action against companies that miss BOI reporting under the CTA until further notice, suspending penalties and fines and that revisions to the deadline and reporting requirements are on the way. This decision effectively halts the enforcement of the act's requirements, with plans to seek public feedback on potential modifications to the BOI reporting rules later in the year.

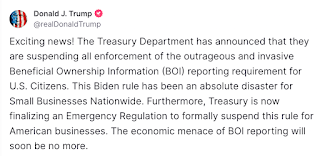

United States Secretary of Treasury Scott Bessent called the move “a victory for common sense” adding “Today’s action is part of President Trump’s bold agenda to unleash American prosperity by reining in burdensome regulations, in particular for small businesses that are the backbone of the American economy.” President Trump himself referred to BOI as an economic menace on his Truth Social account, stating that the Biden rule has been an absolute disaster for Small Businesses Nationwide and hinting at repealing the act altogether.Less than 24 hours after the Treasury Department's announcement, Judge Robert Jonker of the U.S. District Court for the Western District of Michigan declared beneficial ownership information reporting requirements unconstitutional and granting summary judgment to the Small Business Association of Michigan finding the Corporate Transparency Act violates the Fourth Amendment which prohibits unreasonable search.

After the announcements anticorruption and financial transparency advocates in the US and Europe were dismayed by the decision.

Implications for Money Laundering in the Art Market:

As mentioned above, the art market has historically been susceptible to money laundering due to high-value transactions and a lack of close financial oversight. The suspension of BOI reporting enforcement may have severe implications:

Increased Anonymity: Without mandatory BOI disclosures, individuals operating in bad faith can more easily use anonymous entities to conduct art transactions, making it challenging to trace the true ownership of artworks and by proxy the transfer of funds from one geographic region to another as works of art are bought and sold internationally.

Regulatory Gaps: The lack of enforcement creates loopholes that will be exploited for illicit financial activities within the art market.

Challenges for Law Enforcement: The absence of BOI data hampers the ability of authorities to investigate and prosecute transnational money laundering cases involving art transactions.

In 2020 two Russian oligarchs Arkady and Boris Rotenberg, who are close to President Vladimir P. Putin, exploited the opaqueness of the art world to buy high-value art. Bypassing U.S. sanctions, a report by the U.S. Senate’s Permanent Subcommittee on Investigations stated that the brothers purchased of works at auction houses and through private art dealers in New York totalling $18.4 million in value after the pair came under United States sanctions in 2014.

In April 2023 Nazem Ahmad, a collector, was accused by U.S. authorities of being a key financial supporter of Hezbollah, a Lebanon-based organisation designated as a terrorist group by the U.S. government. His indictment alleged that Ahmad circumvented U.S. sanctions, placed on him in 2019, by operating through a network of businesses to obscure multimillion-dollar transactions involving art and diamonds. Additionally, eight other individuals faced charges in connection with the case.

Eric Allouche, whose Allouche Gallery did business with Ahmad stated he had no clue he was dealing with an entity affiliated with the Lebanese collector, indicating that his American-owned gallery dealt with a representative of an entity who he knew to be someone who had bought art previously from artists he handles.

While the stated aim in the suspension of enforcement and potential repeal of this financial transparency law is purported to be to reduce the regulatory burdens on American-owned businesses, weakening the CTA simply reapplies the veil of secrecy which the CTA had sought to remove. If repealed, or left unenforced, it will again enable the concealment of identities, making it easier to clean dirty money through art transactions, and making art world an increasingly elastic haven for hiding criminal transactions.

By: Lynda Albertson